[ad_1]

Modest growth in the second quarter

Growth of 0.4% year-on-year in the second quarter is in fact better than our expectation of -1%YoY, but still paints a gloomy picture of the economy compared to the growth we saw in the first quarter (4.8%YoY). The government has claimed that its stimulus measures prevented a contraction in the second quarter.

Meanwhile, the surveyed jobless rate declined quickly to 5.5% in June from 5.9% in May. This set of data seems to point to a possible bottoming out of the economy.

Recovery of the economy has begun

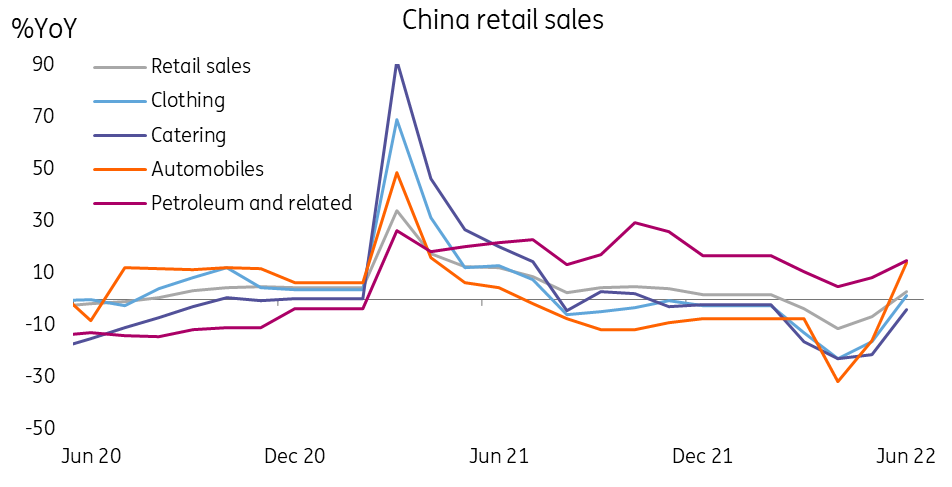

We have seen a recovery in retail sales at 3.1%YoY in June from -6.7%YoY in May, with car sales increasing by 13.9%YoY in June from -5.9%YoY in May, mainly because of subsidies for the consumption of new energy cars. We expect strong retail sales to continue as some local governments have not completed their subsidy programmes.

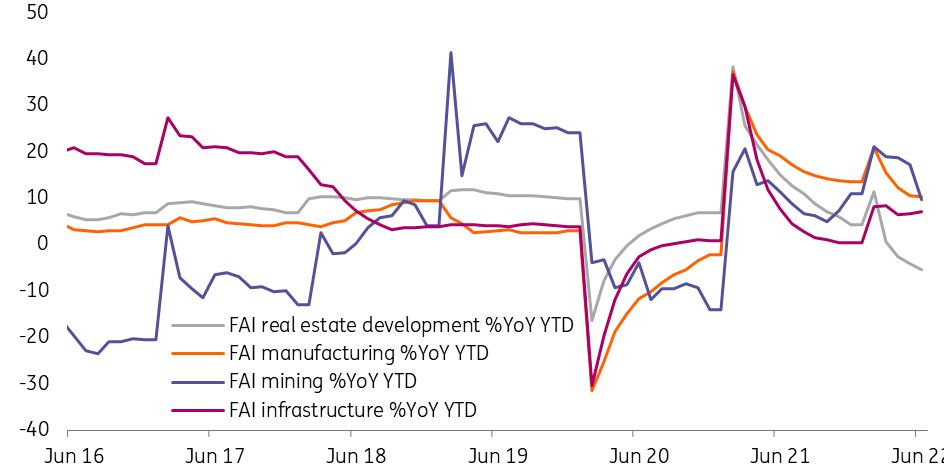

Fixed assets investment data are even more forward-looking. Infrastructure investments grew 6.1%YoY year-to-date amounting to CNY 27.1 trillion. Manufacturing investments took the lead by growing 10.4%YoY YTD. The data suggests companies are optimistic about their buisness prospects. Infrastructure investments rose 7.1%YoY YTD, and we believe they will speed up further in the third quarter.

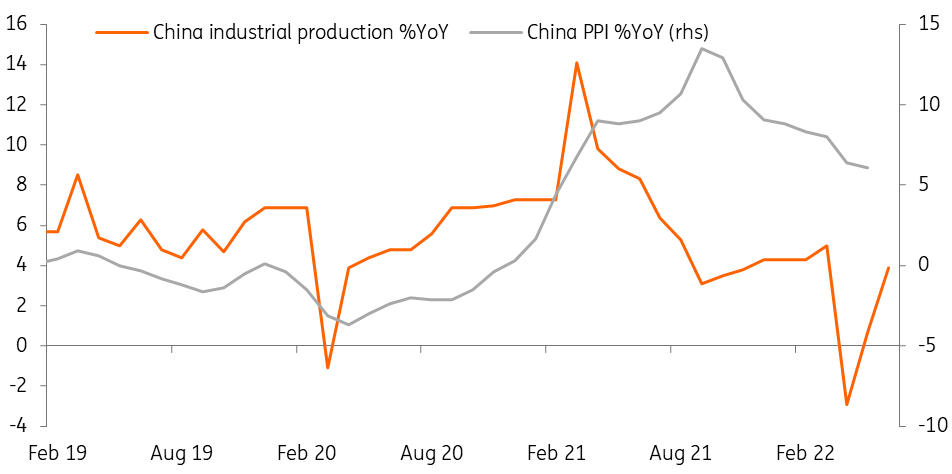

Industrial production rose 3.9%YoY in June from 0.7% in May. New energy cars, solar power batteries and telecommunication stations grew 111.2%YoY, 31.8%YoY and 19.8%YoY, respectively. We believe that subsidies for consumption on new energy cars is one of the factors for such fast growth in production. Faster growth in industrial production will typically push up PPI inflation later. The government is trying to curb inflation so that it can avoid the high readings seen in the US and other economies.

China retail sales

Risks of residential property developers

Even though the economy in general could be bottoming out, it is a different story for property developers. We have not yet seen the end of the tunnel for bond defaults from property developers.

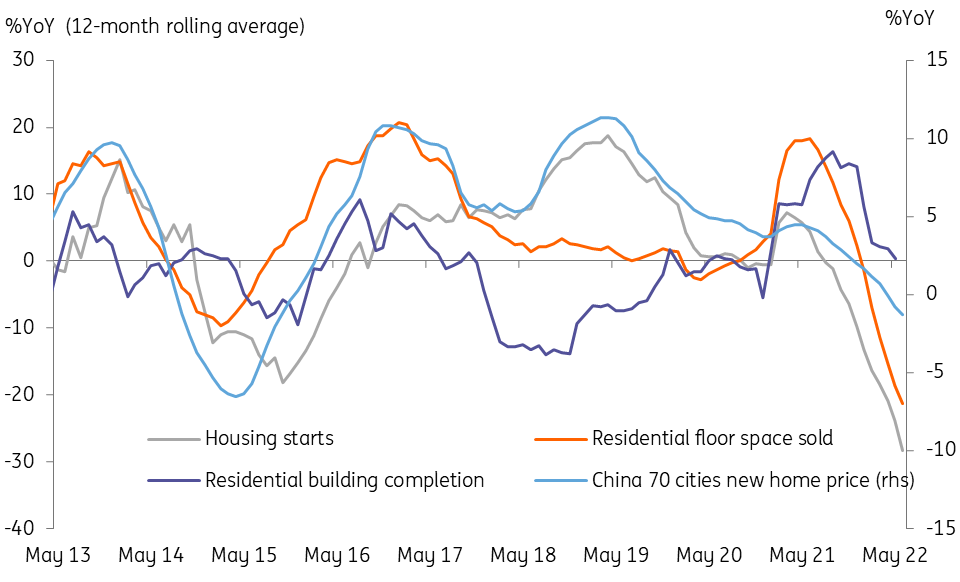

Regarding the risks of property developers, we should focus on their cash flows and their ability to tap the bond market. For those cash-tight real estate developers, they aren’t able to increase their land bank and therefore focus on completion. Slower progress of completion could be because residential property developers have suffered from a fall in funding, of 25.3%YoY YTD in June.

Due to tighter funding, real estate development investments fell 5.4%YoY YTD, and home sales fell 28.9%YoY YTD.

Mortgage delinquency could affect homebuyers’ decisions. They may be more willing to buy homes from developers that have healthy cash flows to complete projects. This could further affect the cash flows of those developers who have difficulty raising funding, and could therefore create a vicious cycle of not being able to sell enough homes to repay debts and even more difficulty tapping the bond market for funding.

China residential property market

People’s Bank of China stays put

China’s central bank, the People’s Bank of China (PBoC), kept the 1Y Medium Lending Facility policy rate unchanged today while rolling over the facility amount. We believe that the central bank is waiting to see the pace of the economic recovery because of the uncertain development of the recent Covid situation in Shanghai.

It’s important to note that we should not mix up this rollover of the facility amount with the mortgage delinquency story that is widely reported because the delinquency amount is relatively small to the whole mortgage portfolio. The rollover of the facility amount is more about the uncertainty of lockdowns during the summer holiday.

Upgrade of GDP forecast

As we believe the economy has bottomed out, we are revising upward China’s GDP growth rate for 2022 to 4.4% from 3.6% previously. It is still slower than the government target of 5.5% for this year. Unless we see a lot of infrastructure being put into construction activities, we believe that it will still be challenging for the economy to reach 5.5% growth.

Source: ING

[ad_2]

Source link