[ad_1]

Voters in the White Lake area will have the opportunity to let their voices be heard regarding a number of candidates and other issues in Tuesday’s primary election, which will set the stage for November’s general election.

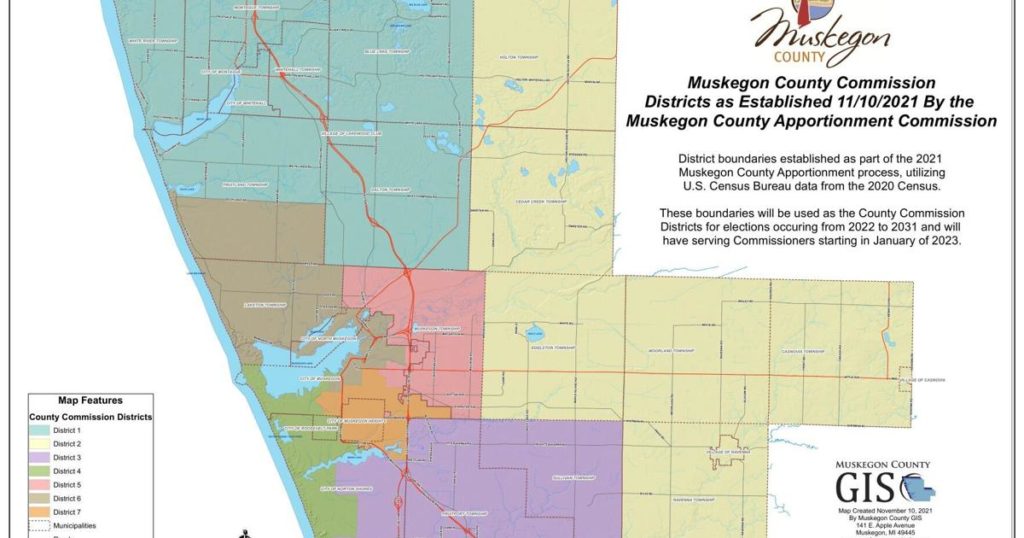

Redistricting is now in effect, changing congressional, state senate, state house of representative and county commissioner districts throughout the state. In Muskegon County, the White Lake area is now District 1 and incumbent Kim Cyr, of Twin Lake, is running for the Republican ticket, with Bruce Froelich, of Montague, running for the Democratic one.

At the state level, five Republican candidates are vying for the ticket against Democratic Governor Gretchen Whitmer. These candidates include: Tudor Dixon of Lansing, Ryan D. Kelley of Allendale, Ralph Rebandt of Farmington Hills, Kevin Rinke of Bloomfield Hills and Garrett Soldano of Mattawan.

In the new 2nd District for Congress, Democrat Jerry Hilliard, of Mt. Pleasant, is unchallenged on his side of the ticket, with Republicans John Moolenaar, of Midland, and Thomas J. Norton of Courtland Township vying for the spot on their side.

In the new 32nd District State Senate, voters will decide between incumbent 34th District State Senator Jon Bumstead, of North Muskegon, and Charles Ritchard, of Hart, to represent the Republican Party in November. Terry J. Sabo, of Muskegon, is the only one running for the Democrat party in that race.

In the state house race, voters will decide between Ryan Roberts of Hart, Andrew Sebolt of Hart, and Curt VanderWall of Ludington to represent the Republican Party in November for the new 102nd District State House seat. Brian Hosticka, of Whitehall, is the lone Democrat in that race. In the new 87th District State House seat, Brennan Gorman of Muskegon, Eddie Jenkins III of Muskegon, Will Snyder of Muskegon and Debra Warren of Muskegon are all vying to represent the Democratic Party in November, with Michael L. Haueisen of Muskegon as the lone Republican in that race.

In the townships, Republican Kristy Houseman-Miles of Twin Lake is running for a partial term as Dalton Township Treasurer; Democrat George W. Dufresne of Montague, is running for a partial term as White River Township Trustee; and Republican Madge Kraai of Whitehall is running for a partial term as Whitehall Township Treasurer.

Non-partisan candidates Kendrah Robinson, Brandon Davis, Jenny L. McNeill, and Jason D. Kolkema are running for Judge of 14th Circuit Court. Gregorcy C. Pittman, Joshua S. EldenBrady-Amrhein, Matthew Kacel and Al Swanson are running for the new judgeship for the 14th Circuit Court.

Millage and bond proposals on the ballot include:

• An Oceana County-wide 2.25 mill request for 20 years for a new county jail and sheriff’s department offices: “Shall the limitation on general ad valorem taxes within Oceana County, as established by Article IX, Section 6 of the Michigan Constitution, against all taxable real and personal property within Oceana County be increased by an additional 2.25 mill ($2.25 per $1,000 of taxable value) for a period of 20 years, 2022 through 2041 inclusive, for the purpose of constructing, equipping, furnishing, financing, and operating a new County Jail and Sheriff’s Department offices, which would replace the existing facilities, subject to reduction as provided by law? If this new additional millage is approved, it is estimated that the levy of 2.25 mill will provide revenue of $3,094,085 in the first calendar year (2023) of the levy, which will be disbursed to Oceana County. As required by law, a portion of the revenue from the millage will be disbursed to tax increment authorities, including the City of Hart Tax Increment Finance Authority.”

• A Grant Township 2 mill request for road construction and maintenance: “Shall the previously voted increase of 2.0000 mills ($2.00 per $1000.00 of taxable value), in the tax limitation imposed under Article IX Section 6 of the Michigan Constitution, on all Real and Personal property in Grant Township, Oceana County, Michigan which expired in 2021 be renewed for a period of two (2) years commencing in the tax year 2022-2023 inclusive for the purpose of providing funds for road construction and maintenance within the Township? It is anticipated that the revenue collected by Grant Township as a result of this proposal will be $159,000.00 in the first year of the levy.”

• A Muskegon County-wide Central Dispatch 9-1-1 Operating .3 mill renewal: “Shall the total constitutional tax rate limitation in the County of Muskegon be renewed the amount of up to .30 cents ($.30) per one thousand dollars ($1,000) (.30 mill) against all taxable property in the County of Muskegon for a period of 7 years beginning with December 1, 2023 levy and ending with the December 1, 2029 levy so as to provide funding for the operations of the “9-1-1 Central Dispatch? If approved and levied in its entirety on December 1, 2023, this millage would raise an estimated $1,400,000 in the first year.”

• A Montague Area Public Schools bonding proposal for $12,730,000: Shall Montague Area Public Schools, Muskegon and Oceana Counties, Michigan, borrow the sum of not to exceed Twelve Million Seven Hundred Thirty Thousand Dollars ($12,730,000) and issue its general obligation unlimited tax bonds therefor, in one or more series, for the purpose of: erecting, furnishing and equipping an addition to the high school building; remodeling, furnishing and refurnishing, and equipping and re-equipping school buildings; acquiring, installing, equipping and re-equipping the high school building for instructional technology; erecting, furnishing and equipping an agricultural barn and a soccer field storage structure; purchasing school buses; and preparing, developing and improving sites?

The following is for informational purposes only: The estimated millage that will be levied for the proposed bonds in 2023, under current law, is 1.08 mills ($1.08 on each $1,000 of taxable valuation) for a -0- mill net increase over the prior year’s levy. The maximum number of years the bonds of any series may be outstanding, exclusive of any refunding, is twenty-four (24) years. The estimated simple average annual millage anticipated to be required to retire this bond debt is 1.96 mills ($1.96 on each $1,000 of taxable valuation). The school district expects to borrow from the State School Bond Qualification and Loan Program to pay debt service on these bonds. The estimated total principal amount of that borrowing is $801,327 and the estimated total interest to be paid thereon is $2,626,577. The estimated duration of the millage levy associated with that borrowing is 15 years and the estimated computed millage rate for such levy is 7.80 mills. The estimated computed millage rate may change based on changes in certain circumstances. The total amount of qualified bonds currently outstanding is $33,180,000. The total amount of qualified loans currently outstanding is approximately $7,377,204. (Pursuant to State law, expenditure of bond proceeds must be audited and the proceeds cannot be used for repair or maintenance costs, teacher, administrator or employee salaries, or other operating expenses.)

A full list of next Tuesdays results will be at whitelakebeacon.com, and in next week’s White Lake Beacon.

[ad_2]

Source link